Key Takeaways

-

Life insurance helps to provide financial protection to your family in the event of your passing.

-

The amount of life insurance you may need varies based on your financial obligations and goals, and whether your employer-provided coverage is enough.

-

Life insurance coverage offered through Associations typically provide customizable options that you can keep as long as you remain a member.

Why is life insurance important?

Life insurance is an important financial tool that helps your loved ones navigate a difficult time by providing financial help after you are gone. It provides a safety net that can help them pay for day-to-day things like groceries and daycare—and long-term responsibilities like the mortgage or rent and saving for college tuition for your kids and retirement. This protection can be essential for anyone with financial dependents, such as family members or business partners, who would face financial difficulties without your support.

Who is life insurance for?

Life insurance is important no matter what stage of life you’re in. If you have someone who depends on you financially (or soon will), you may need life insurance. Whether that includes a parent, spouse or a child, life insurance is meant for anyone who relies on you. The money from a life insurance plan can be left to the ones you love, to use however they like, after you’re gone. By having life insurance, you can help make sure that your dependents are not left in a precarious financial situation.

What type of insurance should I buy?

The type of life insurance plan that may be right for you has a lot to do with where you are in life as well as your financial goals and responsibilities.

Term life insurance is typically a more affordable and straightforward type of plan. A stepped rate term life insurance plan increases the premium gradually over the term of the policy, reflecting the higher risk as you age. If you don’t have a "time-based" financial obligation such as a mortgage or childcare, a plan offering stepped rates, with typically lower upfront costs and rates that increase as you age, could be right for you

Level premium term plans

Level premium term plans offer rates that stay the same for a set period such as a 10- or 20-year term, providing predictable and stable costs.

Variable universal life insurance features coverage with investment options, offering the opportunity to have life insurance protection and the potential to grow your money through accounts that offer stock and bond funds.*

Why is life insurance important for my spouse?

Life insurance can be just as important for your spouse as it is for you, even if they don’t earn an income. Consider all that your spouse does (i.e. childcare, transportation, cooking, etc) and what it would cost to keep your household running in the event of your spouse's untimely death. Life insurance protection helps prevent financial hardship, which could allow you to maintain your standard of living even after your spouse is gone.

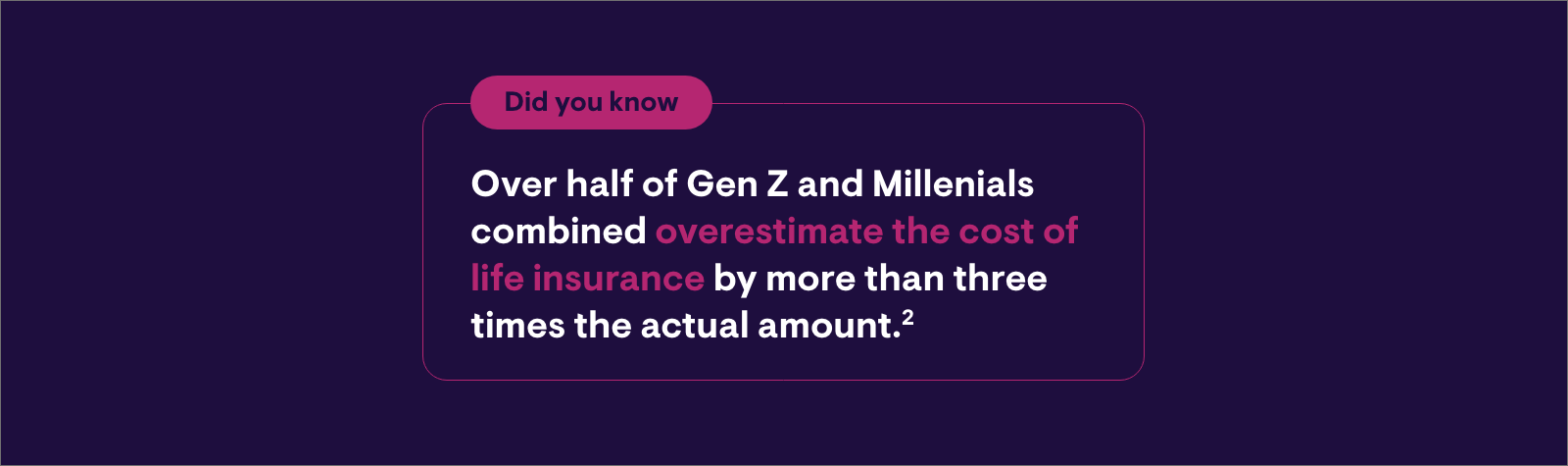

What does it cost?

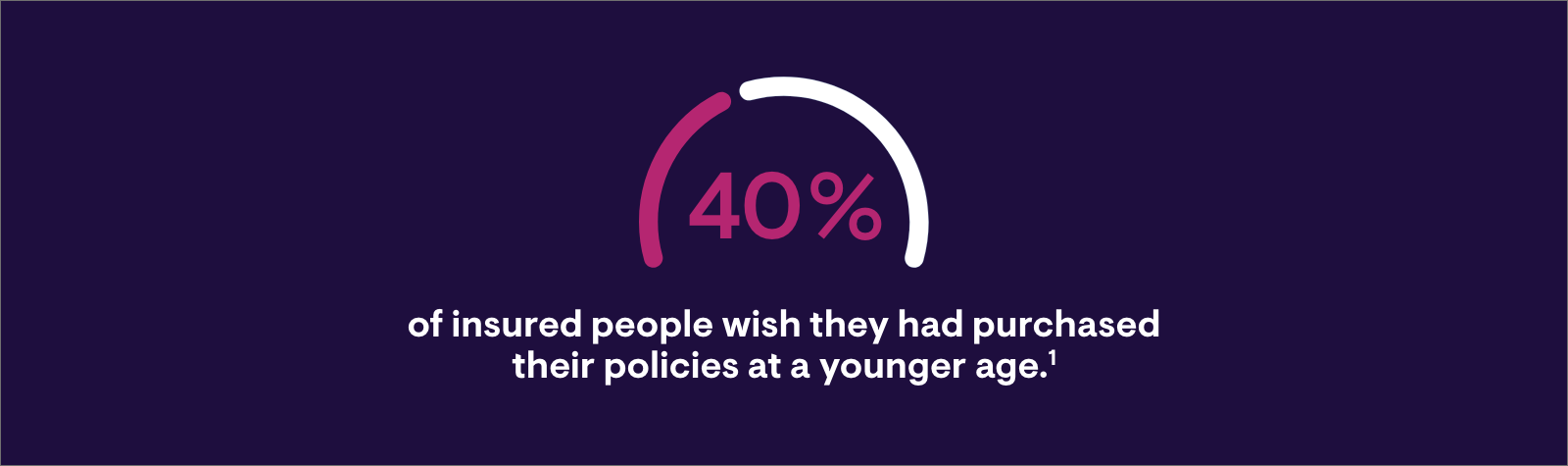

The earlier you buy life insurance, the more affordable it tends to be. For example, a 28-year-old male can get $100,000 in coverage with the CPA Life Plan. Rate classes, which are determined by your health and risk profile, play a significant role in determining the cost of your policy and can greatly impact your premiums.

How much life insurance may I need?

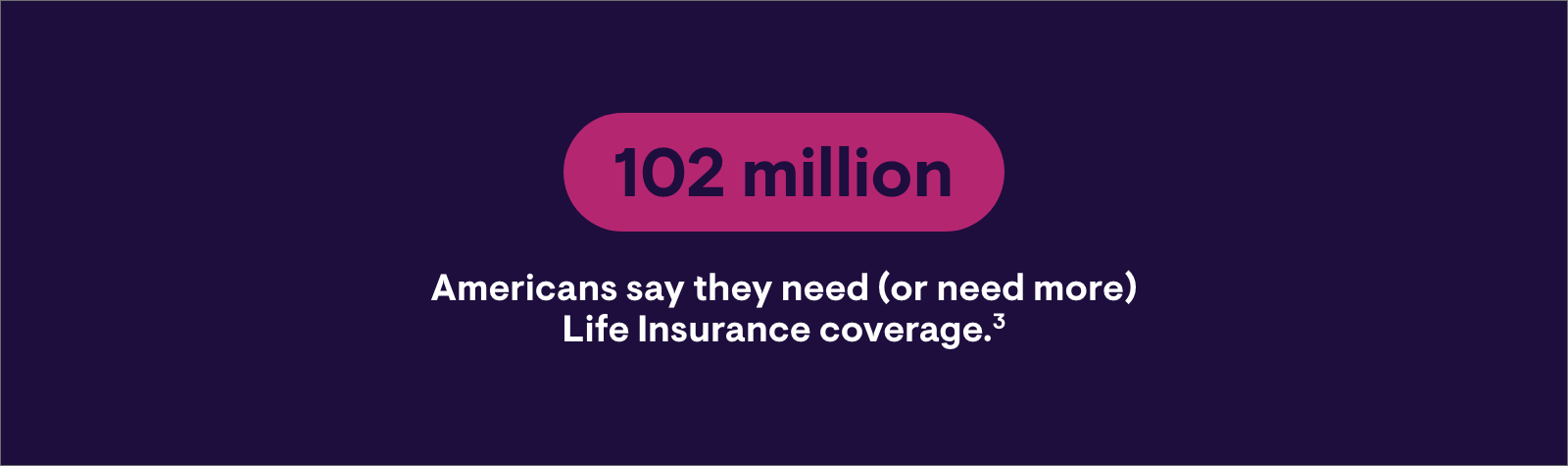

Determining the right amount of life insurance for you, involves assessing your financial obligations, the needs of your dependents, and your long-term financial goals. Being underinsured is almost as bad as not being insured at all—many recommend that you have coverage equivalent to 10-15 times your salary.

3

It's important to evaluate your personal situation and use a

life insurance needs estimator to help you determine the appropriate coverage amount. The tool takes into account your income/savings, expenses/debt, existing coverage amounts, children, and final expenses you might have.

Is my employer's coverage enough?

While many employers offer life insurance as part of their benefits package, this coverage might not be sufficient for your needs. Employer-provided life insurance often offers a basic level of coverage, which may not cover all your financial obligations. It's essential to assess your personal financial situation and consider additional life insurance to ensure you have comprehensive coverage. Coverage is often in multiples of your salary. For example, if you make $50,000 a year, you can buy insurance worth $50,000, $100,000, $150,000, and so on. Higher amounts mean higher premiums.

Benefits of buying coverage on my own

Coverage you have on your own or through an Association (like the AICPA) provides reliable protection even if you change jobs or retire as well as affordable group rates. You can also tailor the coverage to your specific needs and financial situation. Some types of policies can last your entire lifetime as long as premiums are paid, and occasionally include a cash value component that may grow over time. This cash value can be accessed during your lifetime, offering a financial resource if needed. Additionally, some life insurance policies provide flexibility in terms of coverage amounts and policy features, allowing you to choose the best options for your circumstances. Examples include dependent child coverage, accelerated death benefits, accidental death and dismemberment coverage, and disability waiver.

What is the approval process like for life insurance?

The approval process for life insurance typically involves several steps. Initially, you will need to complete an application form, providing personal and health information.

Approval can be fast (many insurers now offer short application processes and instant approval for those who qualify) but typically a brief (in-home or office) medical exam is involved, depending on the policy type and coverage amount. The insurer will then assess your application, considering factors such as age, health, lifestyle, and occupation. If you have a medical condition don’t be discouraged. Medical Underwriting guidelines consider many factors such as date of diagnosis, current treatment, prognosis, etc., offering a better chance for approval. Once the evaluation is complete, the insurer will decide if you’re eligible for the rate class you applied for.

Conclusion

Applying for life insurance isn’t as daunting as it sounds. In fact, the right life insurance plan can help give you peace of mind that your loved ones will have the financial support they may need if the unthinkable happens. AICPA Member Insurance Programs offers a variety of Life Insurance Plans with group-negotiated rates and a wide-range of coverage amounts to help make your decision easier.

Learn more or speak to a dedicated representative who can answer your questions by calling 800.223.7473 Monday-Friday 8:30am-6:00pm, EST

________________________________________________________________________________________

*Policy values will fluctuate and are subject to market risk and to possible loss of principal.

1Forbes Advisor, How Much Life Insurance Do I Need?, Aug 2022

https://www.forbes.com/advisor/life-insurance/how-much-life-insurance-do-you-really-need/

2 LIMRA 2024 Insurance Barometer Study.

https://www.limra.com/en/research/research-abstracts-public/2024/2024-insurance-barometer-study/

3 Life Insurance Fact Sheet, LIMRA, 2024.

https://www.limra.com/siteassets/newsroom/liam/2024/2024-life-insurance-fact-sheet.pdf

IMPORTANT NOTICE — Please visit

www.cpai.com/mib.

In order to keep your AICPA Insurance coverage, you must maintain your membership.

This site may contain marketing language, on products issued by The Prudential Insurance Company of America, that has not yet been approved in all states.

Not for use in New Mexico.

Not for residents of New Mexico.

Accelerated Death Benefit Option for Terminal Illness is a feature that is made available to group life insurance participants. It is not a health, nursing home, or long-term care insurance benefit and is not designed to eliminate the need for those types of insurance coverage. The death benefit is reduced by the amount of the accelerated death benefit paid. There is no administrative fee to accelerate benefits. Receipt of accelerated death benefits may affect eligibility for public assistance and may be taxable. The federal income tax treatment of payments made under this rider depends upon whether the insured is the recipient of the benefits and is considered “terminally ill.” You may wish to seek professional tax advice before exercising this option.

Aon Insurance Services is the brand name for the brokerage and program administration operations of Affinity Insurance Services, Inc. (TX 13695) (AR 100106022); in CA and MN, AIS Affinity Insurance Agency, Inc. (CA 0795465); in OK, AIS Affinity Insurance Services Inc.; in CA, Aon Affinity Insurance Services, Inc. (CA 0G94493), Aon Direct Insurance Administrators, and Berkely Insurance Agency; and in NY, AIS Affinity Insurance Agency. The Plan Agent of the AICPA Insurance Trust, Aon Insurance Services, is not affiliated with Prudential.

Group Variable Universal Life coverages are issued by The Prudential Insurance Company of America and distributed through Prudential Investment Management Services LLC ("PIMS"). Both are Prudential Financial companies, Newark, NJ.

Group Insurance coverages are issued by The Prudential Insurance Company of America, a Prudential Financial company, Newark, NJ. The Booklet-Certificate contains all details, including any policy exclusions, limitations, and restrictions, which may apply. If there is a discrepancy between this document and the Booklet-Certificate/Group Contract issued by The Prudential Insurance Company of America, the Group Contract will govern. In Washington, the controlling document is the Certificate, not the Contract. Contract Series: 83500. CA COA# 1179, NAIC 68241.

1038617-00005-00