As a CPA focused on finances, you might already know the importance of disability coverage, which helps protect your income when an illness or injury prevents you from working. But how well do you know the differences between its two main products: long- and short-term insurance?

Both types of coverage offer benefits that are paid directly to you, giving you the freedom to use the money for whatever you need (the mortgage/rent, childcare, or any other bills you have). Whether you’re considering supplementing your employer-provided coverage or you’re a firm owner and don’t have any at all, it should be a key part of your financial plan.

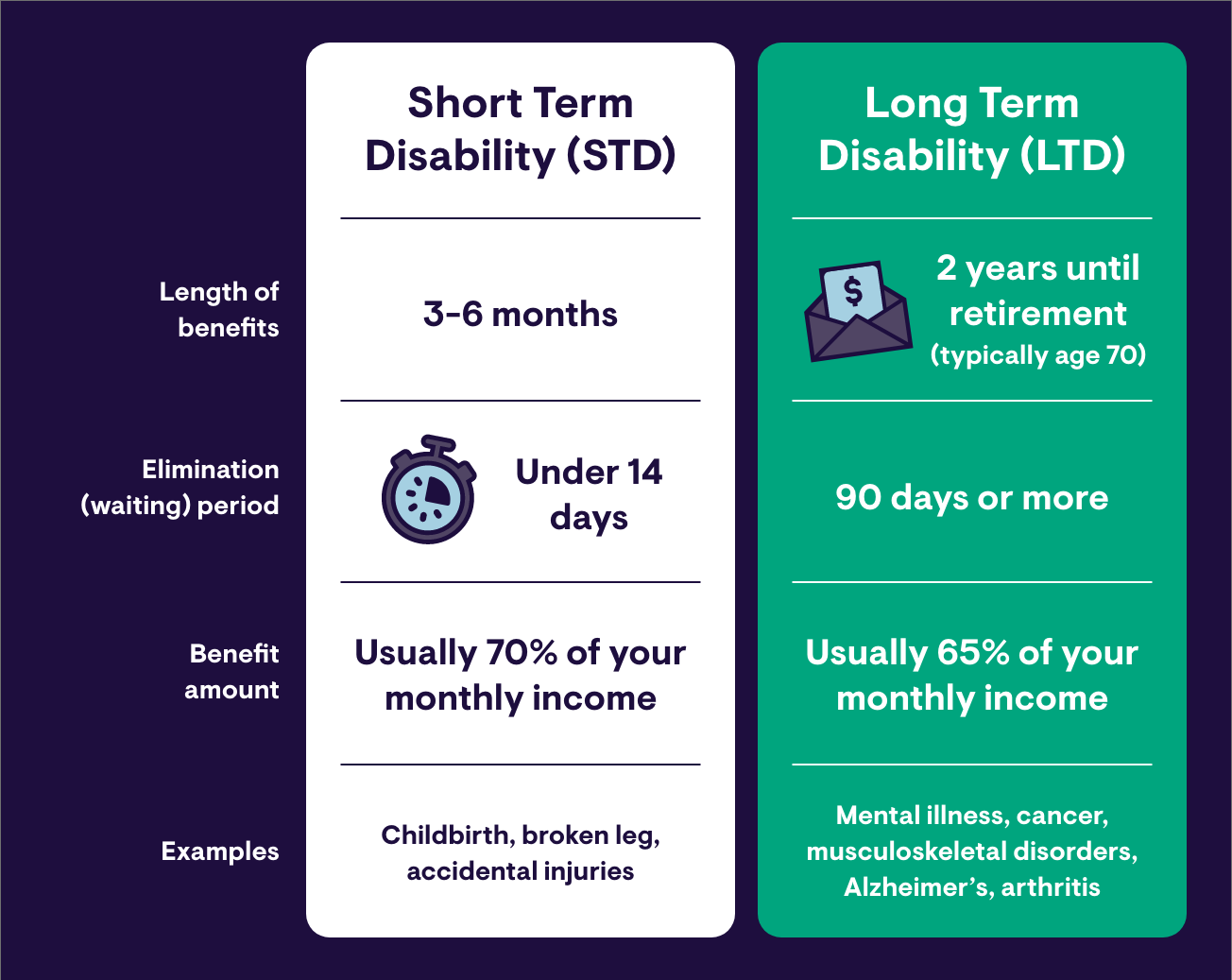

Here are some of the key differences and features for some STD and LTD Plans that you should be familiar with.

Short Term Disability

STD plans typically cover you for a short period of time following an injury or illness that temporarily prevents you from working. The standard duration of benefits is typically 3-6 months and coverage usually replaces up to 70% of your monthly income.

Common reasons you might file a claim are pregnancy, musculoskeletal disorders such as those affecting the back, spine, knees, or hips and digestive disorders like hernias. The waiting period for STD coverage is usually around two weeks; however, the duration of STD coverage is shorter than LTD coverage.

Long Term Disability

The advantage of long-term disability insurance lies in its coverage duration. Compared to short-term plans, it's designed to help you maintain your standard of living over a significantly longer timespan (for disabilities that typically prevent you from working for more than 3-6 months), which is particularly helpful for chronic or severe conditions. Examples of some common disabilities or conditions you could receive benefits for include mental health, back injuries, heart issues, and cancer.

Once the waiting period has been satisfied and if you are approved for coverage, benefits will begin. Benefits can last for years, all the way up to retirement.

The amount you can receive varies by insurer; however, the LTD Income Plan, issued by The Prudential Insurance Company of America, offers the opportunity for instant online approval for up to $12,000 monthly for AICPA members and up to $3,000 for State Society-only members.**

Key Takeaways

Keep in mind that the sooner you apply for long-term disability insurance (and the younger you are), the easier the process will be and the more affordable rates can be. Applications may require medical exams, and under certain LTD plans, certain pre-existing illnesses may disqualify you (AICPA’s LTD Income Plan does not disqualify based on that).

Also, when deciding on a plan, pay attention to its definition of disability and make sure it has a "your occupation" definition, such as what the AICPA LTD Income Plan offers, so you won't be forced into another line of work. You’ll also want to consider a plan that you can keep even if you change/lose your job.

As financial professionals, it's essential to remember that the cornerstone of financial planning lies in preparing for all possibilities, including the potential of loss of income due to disability. Applying for and being approved for coverage in time can be a game-changer, helping to ensure that unforeseen disabling conditions don’t derail your financial stability.

** In certain circumstances, additional information may be needed.

This site may contain marketing language, on products issued by The Prudential Insurance Company of America, that has not yet been approved in all states.

Not for residents of New Mexico.

Not for use in New Mexico.

THIS IS AN EXCEPTED BENEFITS POLICY. IT PROVIDES COVERAGE ONLY FOR THE LIMITED BENEFITS OR SERVICES SPECIFIED IN THE POLICY.

IMPORTANT NOTICE — Please visit www.cpai.com/mib.

North Carolina Residents: THIS IS NOT A MEDICARE SUPPLEMENT PLAN. If you are eligible for Medicare, review the Guide to Health Insurance for People with Medicare, which is available from the company.

This policy provides disability income insurance only. It does NOT provide basic hospital, basic medical, or major medical insurance as defined by the New York State Department of Financial Services.

Aon Insurance Services is the brand name for the brokerage and program administration operations of Affinity Insurance Services, Inc.; (TX 13695)(AR 100106022); in CA & MN, AIS Affinity Insurance Agency,Inc. (CA 0795465); in OK, AIS Affinity Insurance Services Inc.; in CA, Aon Affinity Insurance Services, Inc., (CA 0G94493), Aon Direct Insurance Administrators, and Berkely Insurance Agency; and in NY, AIS Affinity Insurance Agency. The Plan Agent of the AICPA Insurance Trust, Aon Insurance Services, is not affiliated with Prudential.

Group Insurance coverage is issued by The Prudential Insurance Company of America, a Prudential Financial company, Newark, NJ. The Booklet-Certificate contains all details, including any policy exclusions, limitations, and restrictions, which may apply. Contract Series: 83500.

© 2024 Prudential Financial, Inc. and its related entities. Prudential, the Prudential logo, and the Rock symbol are service marks of Prudential Financial, Inc. and its related entities, registered in many jurisdictions worldwide.

1080464-00001-00